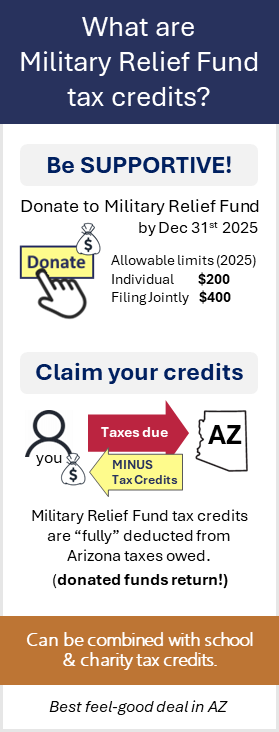

Arizona Military Family Relief Fund (MFRF) Tax Credit

The military relief program assists Arizona service members, Veterans and their families who are facing unforeseen expenses or financial hardships.The State of Arizona permits financial donations to Military Family Relief Fund program to be claimed as fully refundable tax credits. Donations to allowable limits become refundable credits against AZ incomes taxes owed.

The charity fund has a $1 million annual cap for donations to qualify as refundable Arizona tax credits. Once reached, contributions are considered charitable "itemized" donations, not tax credits, therefore best to donate early in the year.

The Military Family Relief Fund donation can be combined with qualified charity (QCOs & QFCOs) and school tax credits, to reduce AZ income taxes owed.